Fresno-based Premier Valley Bank will acquire San Luis Obispo-based Founders Community Bank in a stock-and-cash transaction valued at approximately $29.1 million, or $21.87 per share, the companies announced on Oct. 31.

The parent company of Premier, Heartland Financial USA, aims to acquire Founders, a wholly-owned subsidiary of Founders Bancorp, in a 70 percent stock and 30 percent cash transaction.

The deal signals the continued wave of consolidation in the tri-county banking industry.

“As our board considered our strategic direction in today’s complex banking environment, especially the importance of identifying a potential quality merger partner, Premier Valley Bank, backed by the deep resources of Heartland, stood out as an exceptional opportunity for our customers, employees, community and shareholders,” Thomas Sherman, president and CEO of Founders Community Bank said in a news release. “We are pleased to partner with a strong public company with an expanded array of products and services that’s committed to face-to-face customer service and locally-based community banking.”

Under terms of the agreement, which has been unanimously approved by the boards of directors of both companies, the outstanding common shares of Founders Bancorp will be converted into cash, shares of Heartland common stock, or a combination of the two.

The deal is expected to close in the first quarter of 2017, pending regulatory approval, and Founders Community Bank will be merged into Premier Valley Bank. The combined entity will operate under the Founders name. A Premier branch currently under construction in San Luis Obispo will carry the Founders branding.

The transaction is expected to be a tax-free exchange with respect to the stock consideration received by the shareholders of Founders. Heartland expects the transaction to be accretive to its earnings per share within the first full year of combined operations.

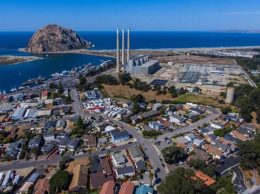

Founders Community Bank is an 11-year-old community bank with approximately $199 million in total assets, $107 million in loans and $180 million in deposits as of the third quarter. Founders’ four branches in the communities of San Luis Obispo, Paso Robles and Morro Bay, along with a lending facility in Atascadero, will remain open, the banks said. When the deal closes, Premier Valley Bank will have nine full-service banking locations and one loan production office in Central California.

As of the end of the second quarter, Premier had $629 million in total assets, $376 million in loans and $515 million in deposits.

“We are growing our presence in California and we see the San Luis Obispo County market area as an economically strong and vibrant region,” Premier Valley Bank CEO Mike McGowan said in a news release. “As one of the last remaining community banks serving San Luis Obispo County, Founders Community Bank is an excellent fit for our community banking business model. Both banks highly value local market knowledge, excellent customer service and deep roots in the community.”

Paso Robles-based Heritage Oaks Bank is also looking to expand its area footprint. It closed the $56 million Mission Community Bank acquisition in February 2014, making it the largest publicly traded, tri-county headquartered community bank in the region. It reported significant gains in net income in 2015 and more than $2 billion in total assets.

Sierra Bancorp, holding company of Bank of the Sierra, completed its acquisition of Coast Bancorp of San Luis Obispo County and its wholly-owned subsidiary Coast National Bank in July.

• Contact Alex Kacik at akacik@pacbiztimes.com.

Print

Print Email

Email