Latest

By Staff Report / Tuesday, November 29th, 2016 / Banking & Finance, Banking Industry, Latest news, Law / Comments Off on Regulatory agencies terminate Heritage Oaks Bancorp consent order

Heritage Oaks Bankcorp said Nov. 29 that state and federal regulatory agencies have terminated a consent order related to the Bank Secrecy Act and anti-money laundering programs at its Heritage Oaks Bank subsidiary. The Paso Robles-based bank is the largest in the region with $2 billion in assets. Heritage Oaks said the Federal Deposit Insurance Read More →

Read More →

Latest

By Marissa Nall / Friday, November 25th, 2016 / middle, Technology, Tri-County Public Companies / Comments Off on 9 tri-county companies on Deloitte Fast 500 list

This article is only available to Business Times subscribers Subscribers: LOG IN or REGISTER for complete digital access. Not a Subscriber? SUBSCRIBE for full access to our weekly newspaper, online edition and Book of Lists. Check the STATUS of your Subscription Account.

Read More →

Latest

By Alex Kacik / Wednesday, November 23rd, 2016 / Banking & Finance, Banking Industry, Latest news, Tri-County Economy / Comments Off on Wells Fargo economist says Trump will likely help economy

President-elect Donald Trump will likely have a positive impact on the regional and national economy in the short term in the form of tax cuts and ramping up defense spending, Wells Fargo Senior Economist Mark Vitner said. Trump claims he will reduce personal and corporate income taxes, which would theoretically spur investment in the U.S. Read More →

Read More →

Latest

By Staff Report / Tuesday, November 22nd, 2016 / Earnings, Latest news, Tri-County Public Companies / Comments Off on QAD’s third quarter net income falls

QAD revenues edged up during its fiscal third quarter 2017, but the company lost ground on net income and earnings per share. Total revenue for the enterprise business software provider, based in Santa Barbara, grew to $69.5 million, up from $68 million for the third quarter last year. Revenue mix continued to trend away from Read More →

Read More →

Latest

By Staff Report / Monday, November 14th, 2016 / Banking & Finance, Banking Industry, Earnings, Latest news, Tri-County Public Companies / Comments Off on OCB Bancorp income grows during third quarter

In its third quarter earnings report, OCB Bancorp — parent company of Ojai Community Bank, Santa Barbara Community Bank, Ventura Community Bank and Santa Paula Community Bank — reported net income year-to-date of $851,000, or 37 cents per share, up from $622,000 last year. Total loans increased by $42 million, or 26 percent, to hit Read More →

Read More →

Latest

By Staff Report / Friday, November 11th, 2016 / Earnings, Latest news, Tri-County Public Companies / Comments Off on Qualstar boosts revenue, narrows loss in third quarter

Simi Valley-based Qualstar Corp. reported a 15 percent increase in revenue in its third quarter earnings report. The data storage manufacturer had $2.7 million in revenue, up from $2.3 million in the same period last year. Its net loss totaled $53,000, or a 3 cent loss per basic and diluted share, compared to net loss of $1.5 million, or a 71 cent Read More →

Read More →

Latest

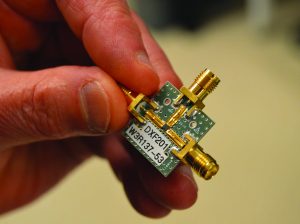

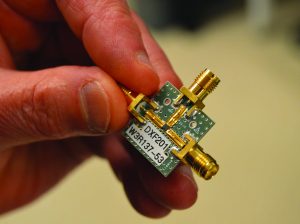

By Staff Report / Thursday, November 10th, 2016 / Earnings, Latest news, Technology, Tri-County Public Companies / Comments Off on Resonant’s third quarter losses grow

Goleta-based Resonant reported a $4 million net loss, or a loss of 39 cents per diluted share, for the third quarter of 2016, up from a $2.9 million — or 40 cents per diluted share — loss in 2015. Revenues from contracts with four customers were $25,000 for the quarter ended Sept. 30. General and Read More →

Read More →