MindBody hits net loss per share estimate

MindBody exceeded analysts’ revenue estimates and hit analysts’ net-loss-per-share estimates when it reported first quarter earnings May 3. MindBody, a San Luis Obispo-based developer of yoga and fitness merchant processing software, posted first quarter revenues of $32 million, exceeding analyst estimates of $30.28 million, up from $22.26 million in 2015, according to S&P Capital IQ. Read More →

Read More →LTC Properties beat first quarter revenue estimates

Westlake Village-based LTC Properties beat analyst projections of revenue and funds from operations in its 2016 first quarter earnings report. The publicly traded real estate and investment trust earned $31.88 million in revenue, up from $26.68 million in the first quarter of 2015, surpassing analyst projections by $820,000. LTC Properties funds from operations per common share Read More →

Read More →

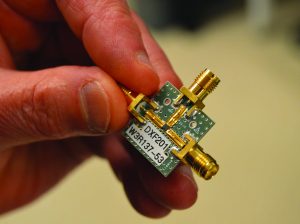

Resonant raises $6 million as it tries to stay afloat

This article is only available to Business Times subscribers Subscribers: LOG IN or REGISTER for complete digital access. Not a Subscriber? SUBSCRIBE for full access to our weekly newspaper, online edition and Book of Lists. Check the STATUS of your Subscription Account.

Read More →Heritage Oaks Bancorp beats analyst estimates for first quarter

Paso Robles-based Heritage Oaks Bancorp beat analyst estimates when it reported first quarter earnings April 28. The company said it had revenues of $19 million, beating analyst estimates of $18.75 million. Earnings per share of 12 cents beat analyst estimates of 11 cents per share. The company also reported net income of $4 million. The Read More →

Read More →Inphi reports revenues up for first quarter

After missing analyst estimates in the fourth quarter of 2015, Inphi bounced back when it reported first quarter earnings April 28. Inphi reported revenues of $66.5 million, up from $59.1 million during the first quarter of 2015. It barely beat analyst estimates of $66.2 million, according to Zacks Investment Research. The company reported net income Read More →

Read More →Amgen exceeds Wall Street expectations for first quarter earnings

Amgen blew away Wall Street expectations and raised its 2016 guidance when it released first quarter earnings April 28. The Thousand Oaks biotech giant had profits of $2.2 billion, up from $1.91 billion during the same quarter last year. Revenues of $5.53 billion were also up from $5 billion in 2015 and surpassed analyst estimates Read More →

Read More →