Higher profits in hand, region’s banks look to expand

Pacific Capital Bancorp, the largest banking company based in the Tri-Counties, turned a $70.5 million profit in 2011 after years of staggering losses. At the same time, First California Financial Group and Heritage Oaks Bancorp, the next two largest banks on the list, reported improved earnings for the year and bold plans to expand. Here’s Read More →

Read More →

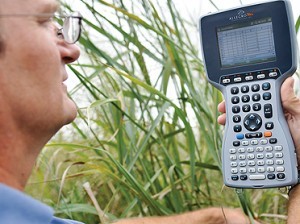

Ceres set to sprout: Crop firm names date for $132M IPO

Ceres plans to go public on Feb. 9, raising as much as $132 million on the Nasdaq under the symbol CERE.

Read More →Fed economist forecasts 2.5% growth this year

Zimmerman: Inflation is expected to be at around 1.5 percent in 2012 and 2013.

Read More →Deckers CEO: Company culture is what counts

In a globalized world, vision and culture are the keys to creating and marketing successful new products. That’s the message Deckers Outdoor Corp. CEO Angel Martinez brought to about 250 Central Coast business leaders at the Feb. 2 Corporate Leaders Breakfast at California Lutheran University. “Our mission is to find niche brands and turn them Read More →

Read More →Inphi taps new CEO after profits fall 93%

Inphi Corp., the Santa Clara-based chip firm with a large engineering force in Thousand Oaks, ousted its CEO on Feb. 1 as it announced that profits plummeted by 93 percent in 2011. Inphi designs chips aimed at packing more memory into Internet servers and increasing bandwidth in the Internet backbone. The company announced that Ford Read More →

Read More →PCBC reports $70.5M in 2011 profits

[wikichart align=”center” ticker=”PCBC” showannotations=”true” livequote=”true” rollingdate=”6 months” width=”390″ height=”245″] Pacific Capital Bancorp, the largest bank based in the region, earned $70.5 million in 2011, its first full calendar year under the ownership of a Texas-based private equity group. The parent company of Santa Barbara Bank & Trust saw its fourth-quarter profits drop 39.8 percent to Read More →

Read More →