Updated: Select Staffing files pre-packaged Ch. 11 bankruptcy

By Staff Report / Tuesday, April 1st, 2014 / Banking & Finance, South Coast, Top Stories / 1 Comment

The Select Staffing Family of Companies, the Santa Barbara-based staffing services giant, filed a pre-packaged Chapter 11 bankruptcy on April 1 listing between $50 million and $100 million in debts and $100 million to $500 million in assets.

Read More →

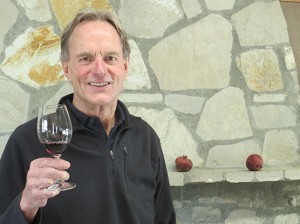

Sanford, free of debt, looks to future at Alma Rosa Winery

By Tom Bronzini / Friday, February 21st, 2014 / Central Coast, South Coast, Top Stories, Tourism, Tri-County Economy, Wine & Viticulture / Comments Off on Sanford, free of debt, looks to future at Alma Rosa Winery

Richard Sanford, free of a crushing debt burden, says he is excited about the future of Alma Rosa Winery and Vineyards and his role there, even though he has lost ownership.

Read More →Court launches bids for eight Nesbitt hotels

By Stephen Nellis / Friday, November 1st, 2013 / Real Estate, South Coast, Top Stories, Tourism / Comments Off on Court launches bids for eight Nesbitt hotels

Montecito hotel magnate Pat Nesbitt could lose as many as half of his Embassy Suites properties under a recently approved bankruptcy reorganization plan.

Nesbitt and his company, Windsor Capital Group, parked a portfolio of eight Embassy Suites hotels in Chapter 11 bankruptcy, listing more than $100 million in debts, after being unable to work out a deal with his servicer, New York-based Torchlight Investors. Nesbitt’s Embassy Suites properties in Lompoc and San Luis Obispo were not involved in the case.

Court documents filed in U.S. Bankruptcy Court in Santa Barbara indicate the eight hotels in the bankruptcy are now slated to go to the auction block.

Read More →

Montecito investor gets sentencing date as ex-wife seeks bankruptcy

By Stephen Nellis / Friday, October 25th, 2013 / Banking & Finance, Law, Real Estate, Top Stories / Comments Off on Montecito investor gets sentencing date as ex-wife seeks bankruptcy

David Prenatt, the Montecito real estate investor who took in $18 million from more than a dozen people and then used the cash to support what a bankruptcy trustee called “lavish spending habits,” is headed for a sentencing in federal criminal court on Dec. 9.

Prenatt struck a deal with federal prosecutors this summer and pleaded guilty to giving false loan application information to Lompoc-based CoastHills Federal Credit Union. Prenatt’s creditors forced him into an involuntary bankruptcy proceeding in 2009. Earlier this fall, his former wife Maria Prenatt filed for personal bankruptcy claiming $27.1 million in debts.

Read More →

Nordman Cormany opts for private liquidation

By Stephen Nellis / Friday, October 4th, 2013 / Banking & Finance, Law, Top Stories / Comments Off on Nordman Cormany opts for private liquidation

This article is only available to Business Times subscribers Subscribers: LOG IN or REGISTER for complete digital access. Not a Subscriber? SUBSCRIBE for full access to our weekly newspaper, online edition and Book of Lists. Check the STATUS of your Subscription Account.

Read More →

Make It Work creditors demand $150K from defunct firm

By Stephen Nellis / Friday, July 26th, 2013 / Banking & Finance, Banking Industry, Law, Technology, Top Stories / Comments Off on Make It Work creditors demand $150K from defunct firm

This article is only available to Business Times subscribers Subscribers: LOG IN or REGISTER for complete digital access. Not a Subscriber? SUBSCRIBE for full access to our weekly newspaper, online edition and Book of Lists. Check the STATUS of your Subscription Account.

Read More →Ch. 7 liquidation clouds Melchiori creditors’ path

By Stephen Nellis / Friday, October 19th, 2012 / Top Stories / Comments Off on Ch. 7 liquidation clouds Melchiori creditors’ path

Creditors to Santa Barbara-based Melchiori Construction Co. face a potentially long and complicated path to recovering any of the millions of dollars they loaned the firm. The general contractor filed for Chapter 7 bankruptcy protection at 9:02 a.m. on Oct. 16 and listed assets of $50,000 or less and debts between $1 million and $10 Read More →

Read More →Popular articles

- None Found

Sponsored content:

SHIPS SLOW TO PROTECT WHALES, BLUE SKIES

-

Sign up for email news

Get the Business Times in your inbox. Sign up for breaking news alerts, our weekly briefing, and more.Sign upFor Email Marketing you can trust.2015-2016 Giving Guide

Check out our 2015 Giving Guide special issue